Online Payment Fraud Detection Market 2022

The global Online Payment Fraud Detection Market is slated to grow on an astute note in the forecast period. The world is on the verge of adopting AR (Augmented Reality), VR (Virtual Reality), and ER (Extended Reality). Though these technologies were confined to gaming initially, the present-day uses comprise simulation software used for training Army, US Navy, and Coast Guard ship captains. The other verticals have also started adapting to these technological advances and would continue to do so further.

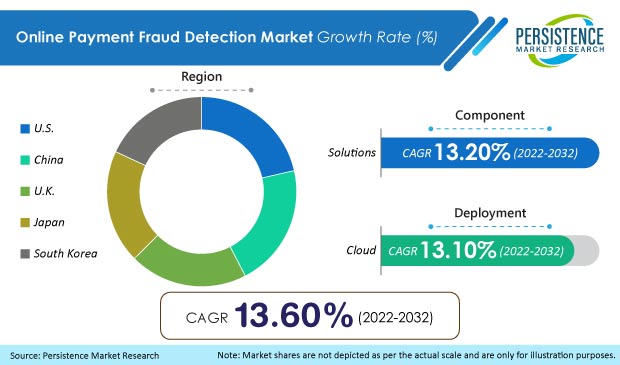

As per a study by Persistence Market Research, from US$ 7 Billion in 2022 to US$ 25.1 Billion in 2032, the global online payment fraud detection market is predicted to grow at a 13.6% CAGR from 2022 to 2032.

Get Sample Copy@https://www.persistencemarketresearch.com/samples/33078

The major factors that are expected to drive the growth of the online payment fraud detection market include increase in revenue loss due to fraud as well as the Adoption of digitalization and IoT, which have increased the adoption rate of fraud detection and prevention system.

The increased use of online payment applications and mobile banking services has resulted in an increase in the number of bogus websites and mobile apps. Fake websites and online apps are on the rise in other industries, including retail and eCommerce, manufacturing, and healthcare. These websites and apps imitate real retail stores and home delivery services, luring clients into making fraudulent online transactions. Customers in the banking industry are increasingly using mobile applications for a variety of purposes, including online payment, statement review, complaint registration, and feedback.

Moreover, the widespread adoption of technologies including card-chip and new digital channels are emerging resulting in fraudsters becoming more adaptive and collaborative with the nature of financial fraud which is growing rapidly. Increasing internet penetration and digitization across emerging and undeveloped economies are propelling the growth of online payment fraud detection market across the globe. Hence financial institutions, merchants, and payment service providers are adopting the artificial intelligence (AI) technology for managing their online payment fraud incidents and reducing fraud losses, thereby enhancing the customer experience.

Request For Customization@https://www.persistencemarketresearch.com/request-customization/33078

- By component, online payment fraud detection solutions is expected to grow at a CAGR of 13.2% during the forecast period

- On the basis of deployment, cloud-based online payment fraud detection to experience a CAGR of 13.1%

- Online payment fraud detection market for the U.S is expected to be worth US$ 8.2 Billion by 2032

- China is expected to reach US $ 2 billion by 2032, growing at a CAGR of 13.1% until 2032

- Japan to have a market size of US$ 1.6 billion by 2032

- U.K is expected to have a market size of US$ 1.1 Billion by 2032, with a CAGR of 12.6%

Competitive Landscape

Major players such as ACI Worldwide, Experian,SecuroNix, Accertify, Feedzai, CaseWare, FRISS, MaxMind, Gurucul DataVisor, PayPal, Visa, SAS institute, SAP SE, Microsoft Corporation, F5, Inc., Ingenico AWS, PerimeterX, OneSpan, Signifyd, Cleafy, and Pondera Solutions, among others are expected to dominate the market share in terms of revenue.

- In April 2021, NICE Actimize launched SURVEIL-X, an AI-powered suitability and surveillance solution for the wealth and insurance sector. The solution developed on holistic surveillance platform called as SURVEIL-X.

- In February 2021, ClearSale LLC launched an e-commerce podcast to detect and mitigate fraud activities. The solution is developed to discuss challenges and emerging trends related to fraud across e-commerce and social media platforms during the ongoing COVID-19 pandemic.

- In November 2020, BAE Systems upgraded its NetReveal KYC/CDD, watch list screening, and anti-money laundering transaction monitoring, and filtering solutions services.

Buy Now@https://www.persistencemarketresearch.com/checkout/33078

Find More Valuable Insights on Online Payment Fraud Detection Market

Persistence Market Research (PMR) published a detailed study on the Online Payment Fraud Detection Market, which includes global industry analysis for 2015-2021 and forecasts for 2022-2032. The report provides an insightful analysis of the market concentration across five different regions, through three different segments – component, deployment, and vertical. The report titled - 'Online Payment Fraud Detection' deliberates current installed base, product usage in various applications from domestic to industrial, as well as prevailing trends and technologies. Along with this, detailed value chain analysis pertaining procurement and aftermarket services has been presented in the report.

About us:

Persistence Market Research, as a 3rd-party research organization, does operate through an exclusive amalgamation of market research and data analytics for helping businesses ride high, irrespective of the turbulence faced on the account of financial/natural crunches.

Contact us:

Persistence Market Research

Address – 305 Broadway, 7th Floor, New York City,

NY 10007 United States

U.S. Ph. – +1-646-568-7751

USA-Canada Toll-free – +1 800-961-0353

Sales – sales@persistencemarketresearch.com

No comments:

Post a Comment